GBP/USD technical analysis: New leg in uptrend unfolds

GBP/USD generally maintains extending its existing uptrend, reaching higher highs and lower lows, and this is likely to remain favoring long positions in pound sterling over short positions.

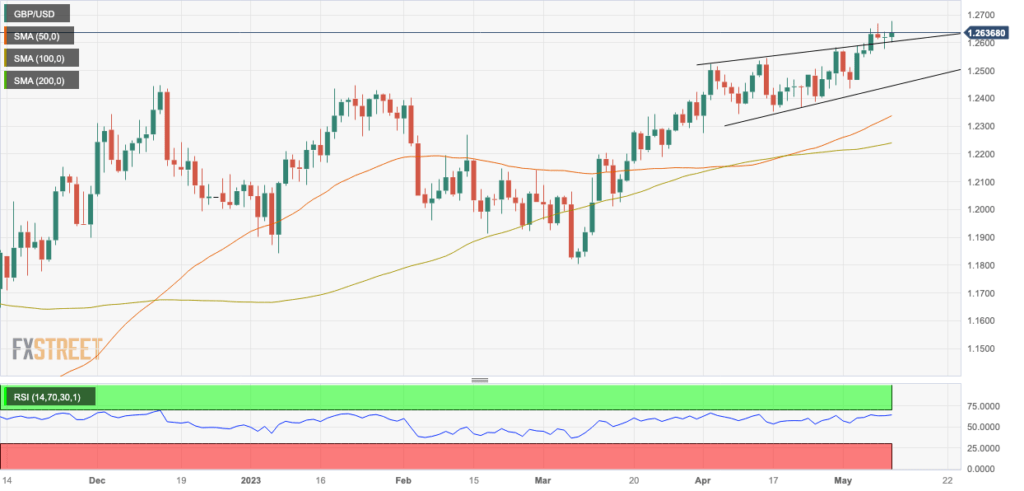

GBP/USD: Daily Chart

On Monday, at the new year-to-date (YTD) highs, the shooting star Japanese candlestick reversal pattern on the GBP/USD failed to get confirmation. The negative follow-through is lacking, and Tuesday’s positive closing further weakens the case for the reversal. The post-CPI rally has now nearly taken back the YTD highs, further invalidating the pattern.

The exchange rate is anticipated to keep rising given the general favorable trend. The first resistance level is the May 2022 highs at 1.2665; however, if it is broken, the 100-week SMA at 1.2713 and the 61.8% Fibonacci retracement of the 2021–22 bear market at 1.2758 can then be reached. All of them offer the pair potential upward goals. To enter the following level, each one must be forcefully breached.

Long daily candles that breach the key resistance levels in issue and close near their day’s highs or lows (depending on whether the break is bullish or bearish) are indicative of decisive bearish breaks. As an alternative, three successive candles that surpass the level can also be significant. Such emblems serve as proof that the break is genuine and not a “false break” or bull/bear trap.

-Advertisement-

In order to cast doubt on the ascending trend’s strength and raise the possibility of a bear reversal, a clear break below the 1.2435 lows from May 2 would be necessary.

The Relative Strength Index (RSI), which peaked on May 5 in the upper 60s, is currently in the mid-60s. This may be the beginning of a slight bearish divergence. At Wednesday’s closing, RSI must be below 68 to confirm a bearish divergence and show some underlying weakness. But this by itself wouldn’t be sufficient proof that a turnabout was imminent.

News Source: By Joaquin Monfort

Credit:FXS

https://theirsondiary.com/index.php/2023/04/09/cwesi4rex-the-art-of-forex-trading/